SETTLEMENTS

On June 13, 2025, the Court approved the Motions to Settle with the D&O Defendants, Sabes Defendants, Mayer Brown and Whitley Penn.

Please click on links below to the Orders for more details.

For information regarding the class action status, please see details below.

Director & Officer (“D&O”) Adversary Proceeding: In April 2024, the Litigation Trustee filed a lawsuit against certain former officers and directors of GWG Holdings, Inc. (“GWG”), including Brad Heppner, a number of trusts and entities related to Mr. Heppner, Beneficient (formerly, The Beneficient Company Group, L.P.), and several entities and trusts affiliated with Beneficient (the “D&O Adversary Proceeding”).

The settlement resolves the Litigation Trustee’s claims against all insured defendants in the D&O Adversary Proceeding, including Mr. Heppner, that arose on or before December 16, 2024. The settlement also resolves claims brought in a parallel putative securities class action (the “Class Action”) pending in the U.S. District Court for the Northern District of Texas (“District Court”). The settlement (and payment of settlement proceeds) from the D&O Adversary Proceeding requires approval of the District Court (in addition to the approval already received from the Bankruptcy Court). Before the WDT is able to make a distribution to Trust Interest Holders, the District Court must approve the Class Action settlement. Approval of the Class Action settlement is a two-step process.

On September 24, 2025, the United States District Court held a hearing on Lead Plaintiff’s Unopposed Motion for Preliminary Approval of Settlement and Approval of Settlement Notice. The following day, the Court entered an order preliminarily approving the Settlement and directing the Noticing Agent, Stretto, Inc., to disseminate the Class Notice in connection with the proposed Settlement. The District Court also set a Final Fairness Hearing on January 13, 2026, to consider Plaintiff’s motion for final approval of the Settlement and Class Counsel’s motion for an award of fees and expenses.

If you would like more information regarding the District Court’s order, a link to the order is provided here.

A second hearing is then required for final approval of the settlement, which would take place in January 2026 at the earliest.

The settlement does not release the Litigation Trust’s claims against trusts and other entities affiliated with Mr. Heppner that the Litigation Trustee alleges received more than $140 million in funds that were improperly transferred from GWG. The Litigation Trustee will continue to pursue claims against those entities.

The settlement amount is $50.5 million.

Whitley Penn LLP: Whitley Penn LLP (“Whitley Penn”) served as GWG’s financial statement auditor. The Litigation Trustee and Whitley Penn reached an agreement to settle the Litigation Trust’s claims for $8.5 million.

Sabes Adversary Proceeding: In April 2024, the Litigation Trustee filed a lawsuit against GWG’s former CEO Jon Sabes, his brother, and several entities associated with the Sabes (the “Sabes Defendants”). The Litigation Trustee and the Sabes Defendants reached an agreement to settle the Litigation Trust’s claims for $2.3 million.

Mayer Brown LLP: Mayer Brown LLP (“Mayer Brown”) served as GWG’s former counsel. The Litigation Trustee and Mayer Brown reached an agreement to settle the Litigation Trust’s claims for $30 million.

The Litigation Trustee’s motions and the settlement agreements are available here:

- Motion to Approve Compromise Under Rule 9019 with Certain D&O Defendants and Exhibits

- Motion of Litigation Trustee and Settling Defendants for Entry of Bar Order in Connection with Settlement of Adversary Proceeding

- Motion to Approve Compromise Under Rule 9019 with Whitley Penn and Exhibits

- Motion to Approve Compromise Under Rule 9019 with Sabes Defendants and Exhibits

- Motion to Approve Settlement Agreement with Mayer Brown and Exhibits

- Notice with Regards to Exhibits

- Supplemental Exhibit to Litigation Trustee’s Motions for Entry of Orders Approving Settlement Agreements

- Estimated Distribution Model Best Case for L Bond Holders

- Second Supplemental Exhibit – Estimated Distribution Notice and Model

- GWG Wind Down Trust Budget

- GWG Litigation Trustee’s Supplemental Notice of Proposed Settlements.

- Notice of Hearing for June 3, 2025

Litigation Trustee’s Motions and Settlement Agreements

- Order for Non-Evidentiary Electronic Scheduling Conference (Jackson Walker Settlement).

- Exhibit B WDT Distribution (RLF, JW, PCA);

- Exhibit C WDT Distribution (All); and

- Distribution Estimations Exhibit B and Exhibit C.

- Motion Approving Settlement Agreement with Jackson Walker;

- Motion Approving Settlement Agreement with Richards Layton;

- Motion Approving Settlement Agreement with Beneficient; and

- Motion Approving Settlement Agreement with Paul Capital Advisors.

- Notice Concerning Exhibits – Richard Layton, Beneficient, Paul Capital; and

- Notice Concerning Exhibits – Jackson Walker.

- Order Approving Settlement with D&O Defendants

- Order Approving Settlement with Whitley Penn

- Order Approving Settlement with Sabes Defendants

- Order Approving Settlement with Mayer Brown

- Order Approving Entry of Bar Order

- Second Amended Notice of Hearing June 13, 2025 Hearings at 9:00 a.m. CST

- Order Resetting Time on June 3, 2025 Hearings to 1:30 pm from 9:00 am CST

- Motion to Approve Compromise Under Rule 9019 with Certain D&O Defendants and Exhibits

- Motion of Litigation Trustee and Settling Defendants for Entry of Bar Order in Connection with Settlement of Adversary Proceeding

- Motion to Approve Compromise Under Rule 9019 with Whitley Penn and Exhibits

- Motion to Approve Compromise Under Rule 9019 with Sabes Defendants and Exhibits

- Motion to Approve Settlement Agreement with Mayer Brown and Exhibits

- Notice with Regards to Exhibits

- Supplemental Exhibit to Litigation Trustee’s Motions for Entry of Orders Approving Settlement Agreements

- Estimated Distribution Model Best Case for L Bond Holders

- Second Supplemental Exhibit – Estimated Distribution Notice and Model

- GWG Wind Down Trust Budget

- GWG Litigation Trustee’s Supplemental Notice of Proposed Settlements

- Notice of Hearing for June 3, 2025

What is the total amount to be received from the settlements? How much are attorneys’ fees and expenses?

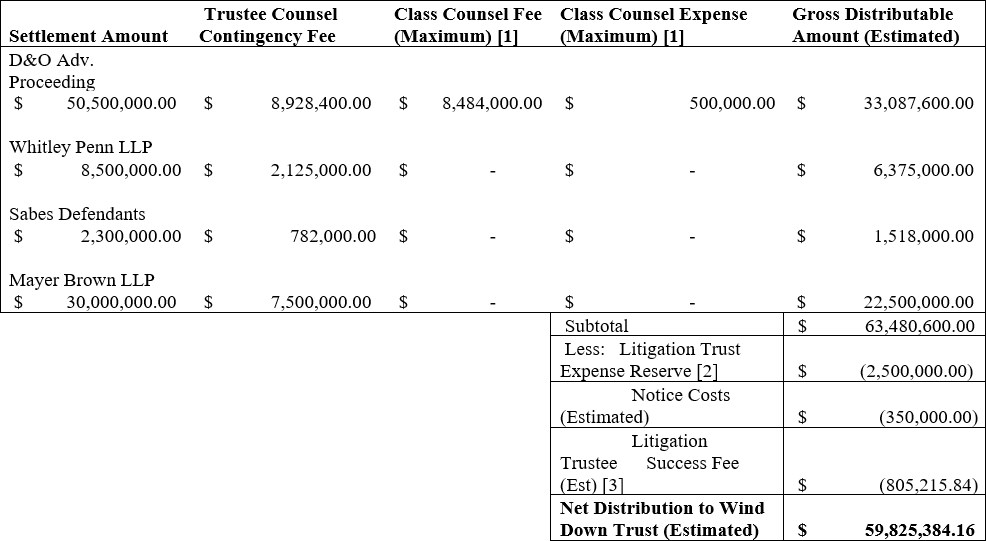

The four settlements, (if the D&O Settlement is approved by the District Court), will result in $91.3 million in total gross recoveries to the Litigation Trust. After fees, expenses, and replenishing the Litigation Trust reserve, the Litigation Trustee estimates that approximately $59.8 million will be available for distribution by the Wind Down Trust to WDT Interest holders. The following chart shows the anticipated gross proceeds, fees and expenses associated with each settlement:

[1] The proposed settlement of claims asserted in Goldberg v. Heppner, et al., Adv. Pro. No. 24-03090, also resolves claims in a parallel putative securities class action pending in the U.S. District Court for the Northern District of Texas (the “District Court”), styled In re GWG Holdings, Inc. Sec. Litig., No. 3:22-cv-00410 (the “Class Action”). Under the terms of that settlement agreement, Class Counsel will apply to the District Court for a fee payment in an amount not to exceed $8,484,000 plus reimbursement of expenses in an amount not to exceed $500,000. [Dkt No. 2533-1 at ¶ 22].

[2] This amount represents a reserve by GWG Litigation Trustee to fund reasonably anticipated expenses associated with multiple pending arbitrations and adversary proceedings, in accordance with the terms of the GWG Litigation Trust Agreement. See Dkt No. 1910 at §3.4.

[3] The GWG Litigation Trustee’s compensation under the GWG Litigation Trust Agreement includes a success fee comprised of (a) 2% of the net amount available for distribution to the Wind Down Trust Beneficiaries plus (b) 2% of the amount of any fees and expenses paid to any experts and/or contingency counsel retained by the Litigation Trustee on behalf of the Litigation Trust (“Success Fee”). See Dkt No. 1910 at Schedule A. At the time a Success Fee is paid, 50% of all monthly compensation paid or payable to the Litigation Trustee is credited against any Success Fee. Id. Because this credit depends on when the Settlements are approved and ultimately fund, this amount is based on the Litigation Trustee’s best current estimate as to the timing of each and therefore may be subject to change. Further, for the settlement with the D&O Defendants [Dkt No. 2533], the Success Fee is calculated solely on the portion of the settlement allocated to the GWG Litigation Trust (52%), net of fees owed to the Litigation Trustee’s counsel; it excludes amounts allocated to settle the Class Action.

How much money will the Wind Down Trust distribute to WDT Interest holders from the settlement proceeds?

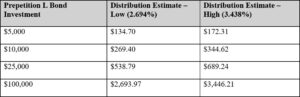

If the District Court approves the settlement with the D&O Defendants, the Wind Down Trust estimates that the cumulative distribution from the four settlements will be between 2.694% and 3.446% of the approximately $1.67 billion in pre-petition GWG L Bond holdings that are now classified as Series A1 WDT Interests. The anticipated distribution amount to a typical former GWG bondholder for each of the low and high distribution estimates is:

The percentages referenced above reflect the estimated distribution as a percentage of the approximately $1.67 billion in pre-petition GWG L Bond holdings (now Series A1 WDT Interests). However, for the reasons discussed below, former GWG bondholder claims significantly exceed the amounts the Litigation Trustee might recover as damages through litigation.

Each settlement represents a higher percentage share of damages the Litigation Trust is seeking or could seek against each of the settling parties. If all four settlements are approved, the $91.3 million in total settlements (i.e., before deducting attorney’s fees and expenses) represents between 17% and 28% of the Litigation Trustee’s maximum estimated damages. The estimated $59.8 million that the Wind Down Trust will distribute to WDT Interest holders represents between 11% and 18% of the Litigation Trustee’s maximum estimated damages (without accounting for possible future recoveries from other cases the Litigation Trustee is still pursuing).

Why is there a range of possible distributions to WDT Interest holders?

The Debtors’ confirmed Chapter 11 Plan specifies how the Wind Down Trust must distribute proceeds it receives from the Litigation Trust. To summarize, the Chapter 11 Plan provides that proceeds the Wind Down Trust receives are first to be used to pay “Indenture Fee and Expense Claims” and then to Series A1 WDT Interest holders “on account of the Indenture Diminution Claim.” Once those amounts are paid in full, any further proceeds are then paid on a pro rata basis to Series A1, A2, and B WDT Interest holders up to certain amounts, and so on under the Chapter 11 Plan.

The Chapter 11 Plan, however, did not specify the amount of the “Indenture Diminution Claim.” As a result, the Wind Down Trust is in negotiations to set the amount of the “Indenture Diminution Claim.” In addition, the Wind Down Trustee and Litigation Trustee are in negotiations that may affect the total amount of Series B WDT Interests, which represent general unsecured creditor claims. Because the outcome of those negotiations will impact the amount distributed to former GWG bondholders, the Wind Down Trust cannot yet provide an exact distribution amount to former bondholders.

Why does the Litigation Trustee believe these settlements are best for the GWG Litigation Trust and the Wind Down Trust’s underlying interest holders?

The Litigation Trustee believes that the settlements are fair and are in the best interest of the WDT Interest holders.

Although the Litigation Trustee believes that the claims that have been asserted have merit, that does not mean that the Litigation Trust is guaranteed to win at trial. In evaluating the settlement, the Litigation Trustee must balance the strength of the claims against legal and practical considerations. The Litigation Trustee evaluated a number of factors in deciding to accept the settlements.

In each of the cases being settled, the Litigation Trustee’s claims are legally complicated and the facts giving rise to those claims are complex. As a result, it is far from certain that the Litigation Trustee would win at trial or on appeal. The defendant(s) in each case have defenses, and the Litigation Trustee faces impediments to proving liability. Indeed, the defendant(s) in each case has and would continue to vigorously defend the claims. Moreover, litigating the claims would be expensive, and it could take many years to litigate through judgment and the appeals that would likely follow.

In the meantime, the settling defendants would be spending the insurance or other resources that could be used to pay WDT Interest holders. The Litigation Trustee has evaluated the settling defendants’ ability to pay and the likelihood that the Litigation Trust could successfully collect a judgment.

The Litigation Trustee weighed these litigation and collection risks against the benefits of settling now on the terms negotiated by the Litigation Trust. In the Litigation Trustee’s judgment, these settlements are in the best interests of the WDT Interest holders because they eliminate the risk that the Litigation Trust will receive less or nothing at all following a trial, and the settlements will allow distributions to WDT Interest holders once the settlements are approved, rather than years from now, assuming the Litigation Trust wins at trial and on appeal.

Importantly, the Litigation Trust has reserved its claims against the Reserved Trust Action Defendants (i.e., Heppner-affiliated entities and trusts) that the Litigation Trustee alleges received over $140 million from GWG. The Litigation Trustee will continue to pursue these claims against the Reserved Trust Action Defendants, as well as the other defendants identified below.

Would I be paid in full if the Litigation Trust was to pursue, win, and collect a judgment in the D&O Adversary Proceeding (or any other case) instead of settling?

No. Even if the Litigation Trustee won the D&O Adversary Proceeding (including any appeals) and was able to collect that entire judgment, the best case scenario is that you would receive 19% to 31% of your losses before deducting attorneys’ fees and expenses.

GWG had over $1.67 billion in total bond debt at the time it filed for bankruptcy. Setting aside the collection risks discussed below, the maximum recovery the Litigation Trustee can legally seek in the D&O Adversary Proceeding and other cases is a fraction of bondholder losses. This is due to the nature of the claims assigned to the Litigation Trust: the Litigation Trust can only pursue claims for damages suffered by GWG (discussed below), and those damages are not the same as the more than $1.67 billion in losses suffered by GWG bondholders.

For instance, the Litigation Trustee is seeking $25.7 million in damages from the Sabes Defendants. As to the other settling parties, the Litigation Trustee estimates at this time that the maximum amount that can be recovered in total damages ranges from $300 million to $500 million, although the actual recoverable damages could be significantly less. These damages generally correspond to the approximately $300 million that the Litigation Trustee alleges GWG improperly transferred in connection with damages involving Beneficient and other related entities, as well as other potential types of damages (such as costs associated with GWG’s bankruptcy).

However, the $300 million to $500 million estimated range of maximum damages is not per case or per defendant, but rather the cumulative maximum for all of these claims, which involve many different parties that dispute both the claims of liability and the range of possible damages. Moreover, it is important to note that the range of total damages is dependent on a number of factors, the most important of which is Beneficient’s value at the time of each transaction or transfer. The Litigation Trustee has alleged that Beneficient—and particularly the debt and equity GWG received—was worth far less than represented. But if at trial a court or jury determines that Beneficient’s value was as represented, the damages the Litigation Trust could recover could be significantly less.

This means that the maximum amount that the Litigation Trust could possibly win (without accounting for the significant risk that it could lose, and recover nothing, or win only a portion of the damages sought, which could be less than the settlement amount) is somewhere between 19% and 31% of GWG bondholders’ total losses before deducting attorneys’ fees and expenses. Once fees and expenses are deducted, the Litigation Trustee estimates that, in a best case litigation scenario, less than 20% of GWG bondholder losses could ever be paid from a judgment in the D&O Adversary Proceeding—assuming the Litigation Trustee could successfully collect such a judgment, which is highly unlikely, as discussed below—or the other cases the Litigation Trustee is pursuing.

As a result, there is no scenario in which litigating the D&O Adversary Proceeding (or any other case) through trial could result in GWG’s former bondholders receiving more than 20% of their investment back.

Could I receive more if the Litigation Trust were to pursue the claims in the D&O Adversary Proceeding to trial and win?

In the Litigation Trustee’s judgment, former GWG bondholders are unlikely to receive more if the settlement of the D&O Adversary Proceeding is rejected. As explained in more detail in the Litigation Trustee’s motion for approval of the settlement, even if the Litigation Trustee were to win a judgment against the insured defendants (which is far from certain), there is a very real risk that the Litigation Trust would not collect anywhere near that amount from those defendants. This is what the Litigation Trustee’s motion refers to as “collection risk.”

The surest way for the Litigation Trust to avoid this collection risk is by recovering from GWG’s D&O Liability Insurance Policies. But much of that money has already been spent on the settling defendants’ defense costs, and absent the approval of this settlement, that spending will continue to reduce the amount of insurance proceeds available to pay the Litigation Trust (and ultimately, former GWG bondholders).

According to the Debtors’ disclosure statement, approximately $146 million in coverage under the D&O Liability Insurance Policies remained in April 2023. By December 2024, however, only $77 million to $80 million remained on those policies. Given the complexity of the litigation and the number of individual defendants who share the right to reimbursement from the D&O Liability Insurance Policies for attorneys’ fees incurred in defending the D&O Adversary Proceeding and other pending legal proceedings, the Litigation Trustee believes that the insurance policies that are funding the settlement will be spent by the time a trial takes place. This means that no insurance money will be available to pay a judgment.

Given this possibility, the Litigation Trustee looked at whether the insured defendants that are part of the settlement have assets that could be used to pay a judgment without insurance money. Based on that analysis, the Litigation Trustee concluded that the Litigation Trust (and therefore former GWG bondholders) are likely to recover less than the settlement amount even if the Litigation Trustee was to win at trial.

Many of the assets that the individual defendants have are protected by generous Texas homestead laws (or similar exemptions) and cannot be used to pay a judgment. Certain individual defendants (like Brad Heppner and Thomas Hicks) appear to hold most of their assets through entities or trusts. But state law severely limits the Litigation Trustee’s ability to seize assets held in certain types of trusts and entities, such as limited liability companies, to satisfy a judgment against an individual. Thus, even if the Litigation Trustee won a judgment against those individuals, the Litigation Trustee could not simply seize assets held in entities or trusts to pay the judgment against the individual. Finally, Beneficient’s public filings indicate that it has few readily available, unencumbered assets to satisfy a judgment.

This means that the Litigation Trust could spend three to five years (or more) to get through a trial and appeals only to collect less than $50.5 million from the insured defendants. This is one of the principal reasons the Litigation Trustee agreed to the settlement: the Litigation Trustee believes the $50.5 million in insurance money available to fund the settlement is the greatest amount the Litigation Trust will recover from the insured defendants in the D&O Adversary Proceeding.

Are these settlements the only opportunity for WDT Interest holders to be paid from the Litigation Trust and/or Wind Down Trust?

No, the Litigation Trustee will continue pursuing and investigating other cases and claims which the Litigation Trustee expects (but does not guarantee) will result in additional recoveries. If the settlements are approved, there still will be four pending cases or arbitrations already filed by the Litigation Trustee.

First, the Litigation Trustee will continue to pursue claims against the various trusts and entities affiliated with Mr. Heppner. The settlement agreement refers to these remaining defendants as the “Reserved Trust Action Defendants.” Of the $300 million that the Litigation Trustee alleges GWG improperly transferred in connection with transactions involving Beneficient entities, the Litigation Trustee alleges that over $140 million ultimately flowed to the Reserved Trust Action Defendants. The Reserved Trust Action Defendants will not be released if the settlement in the D&O Adversary Proceeding is approved, and the Litigation Trustee will continue to pursue claims against the Reserved Trust Action Defendants. It is uncertain whether the Litigation Trustee will be successful in pursuing claims against the Reserved Trust Action Defendants. It is also unclear what amounts can be recovered from the Reserved Trust Action Defendants, if any.

The three other remaining matters are: (1) the Litigation Trust’s adversary proceeding against Holland & Knight LLP; (2) an arbitration against Foley & Lardner LLP; and (3) a confidential arbitration against another of GWG’s former professionals.

In addition, the Litigation Trust is continuing to investigate claims against a number of other potential defendants, which may result in additional claims being filed and additional settlements. There can be no guarantee as to the outcome of these proceedings.

If the settlements are approved, how soon will I receive a distribution from these settlement proceeds?

The settlement of the D&O Adversary Proceeding must be approved by the District Court where the Class Action is pending. The attorneys for the plaintiff in the Class Action have initiated the process for approval by the District Court.

On September 24, 2025, the United States District Court held a hearing on Lead Plaintiff’s Unopposed Motion for Preliminary Approval of Settlement and Approval of Settlement Notice. The following day, the Court entered an order preliminarily approving the Settlement and directing the Noticing Agent, Stretto, Inc., to disseminate the Class Notice in connection with the proposed Settlement. The District Court also set a Final Fairness Hearing on January 13, 2026, to consider Plaintiff’s motion for final approval of the Settlement and Class Counsel’s motion for an award of fees and expenses.

The Wind Down Trust will post updates about the approval process to the Trust website, as well as an anticipated date for payment.